However, prevailing market rates are 5%, and tenure of these debt instruments is 15 years. A bond is a debt instrument in which corporations issue to investors to raise money for projects, to purchase assets, and to fund the expansion of the business. Bonds are sold to investors in which the corporation gets paid the principal amount or the face value of the bond. A municipal bond has call features that may be exercised after a set time period such as ten years. A callable security is a bond or other type of security issued with an embedded call provision that allows the issuer to repurchase or redeem the security by a specified date. That simply means the issuer retires (or pays off) the bond by returning the investors’ money.

Do callable bonds have higher yields?

A business may choose to call their bond if market interest rates move lower, which will allow them to re-borrow at a more beneficial rate. Callable bonds thus compensate investors for that potentiality as they typically offer a more attractive interest rate or coupon rate due to their callable nature. To compensate callable security holders for the reinvestment risk they are exposed to and for depriving them of future interest income, issuers will pay a call premium. The call premium is an amount over the face value of the security and is paid in the event that the security is redeemed before the scheduled maturity date.

Understanding Callable Bonds: Definition, Examples, and How They Work

The higher coupon rates offered by callable bonds help offset lower returns from other fixed-income securities. New issues of bonds and other fixed-income instruments will pay a rate of interest that mirrors the current interest rate environment. If rates are low, then all the bonds and CDs issued during that period will pay a low rate as well. However, issuers of fixed-income investments have learned that it can be a drain on their cash flow when they are required to continue paying a high-interest rate after rates have gone back down.

Callable Bonds Explained

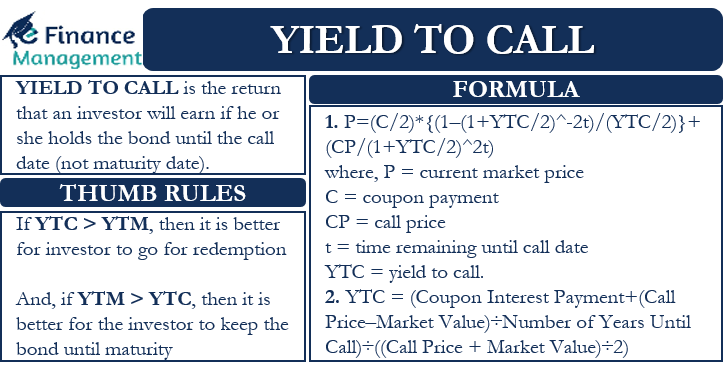

The potential for the bond to be called at different dates adds more uncertainty to the financing (and impacts the bond price/yield). If the yield to worst (YTW) is the yield to call (YTC), as opposed to the yield to maturity (YTM), the bonds are more likely to be called. For example, a bond issued at par (“100”) could come with an initial call price of 104, which decreases each period after that. The excess of the call price over par is the “call premium,” which declines the longer the bond remains uncalled and approaches maturity. Issuers can buy back the bond at a fixed price, i.e. the “call price,” to redeem the bond.

Bermuda Callable Bonds

To compensate investors for this uncertainty, an issuer will pay a slightly higher interest rate than would be necessary for a similar noncallable bond. Additionally, issuers may offer bonds that are callable at a price above the original par value. For example, the bond may be issued at a par value of $1,000, but be called away at $1,050. The issuer’s cost takes the form of overall higher interest costs, and the investor’s benefit is overall higher interest received.

Callable Bonds

If interest rates have declined since the bond was issued, the company can issue new debt at a lower interest rate than the callable bond. The company uses the proceeds to pay off the callable bonds by exercising the call feature. In addition to reinvestment-rate risk, investors must also understand that market prices for callable bonds behave differently callable bond meaning than standard bonds. This phenomenon is called price compression, and it is an integral aspect of how callable bonds behave. Consider the example of a 30-year callable bond issued with a 7% coupon that is callable after five years. In this instance, the issuer would probably recall the bonds because the debt could be refinanced at a lower interest rate.

On the surface, Firm B’s callable bond seems more attractive due to the higher YTM and YTC. Essentially, callable bonds represent a standard bond, but with an embedded call option. Put simply, the issuer has the right to “call away” the bonds from the investor, hence the term callable bond.

- Effective tactical use of callable bonds depends on one’s view of future interest rates.

- A sinking fund has bonds issued whereby some of them are callable for the company to pay off its debt early.

- Additionally, issuers may offer bonds that are callable at a price above the original par value.

- For noncallable securities or for a bond redeemed early during its call protection period, the call premium is a penalty paid by the issuer to the bondholders.

- Therefore, the company pays the bond investors $10.2 million, which it borrows from the bank at a 4% interest rate.

The series of call dates is known as a call schedule, and for each of the call dates, a particular redemption value is specified. Logic dictates that the call date provision will only be exercised if the issuer.feels that there is a benefit to refinancing the issue. Investors who depend on the interest income generated from bonds must be aware of the call date when buying a bond. Although callable bonds can result in higher costs to the issuer and uncertainty to the bondholder, the provision can benefit both parties. Corporations can redeem American callable bonds early without the investor’s consent. As a result, investors should not only be aware of the scenarios in which a bond is likely to be called, but also the risks posed to investors from an early redemption.

This requires the issuer to recall a certain amount or all of the bonds according to a fixed schedule. A sinking fund is money that a company reserves on the side to pay off a bond. Some bonds have call protection which forbids the issuer to buy it back for a certain period of time. However, at the end of this period, the issuer can redeem the bond at its specified call date. When the issuer calls the bond, it pays investors the call price or the face value of the bond, along with the accrued interest to date.